By Ronan Martin

(Bloomberg) — European regulators are rushing to reassure

investors that shareholders should face losses before

bondholders after the takeover of Credit Suisse Group AG wiped

the bank’s Additional Tier 1 debt.

The clauses that led to the bonds being marked to zero

aren’t common. Only the AT1 bonds of Credit Suisse and UBS Group

AG have language in their terms that allows for a permanent

write-down and most other banks in Europe and the UK have more

protections, according to Jeroen Julius, a credit analyst at

Bloomberg Intelligence.

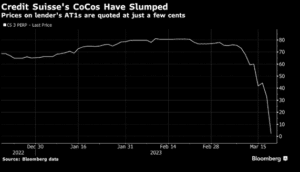

Yet, judging by the market action, investors aren’t

sticking around to find out. All kinds of risky bank debt

tumbled on Monday and analysts predicted far-reaching

consequences to Europe’s funding market. The market for new AT1

bonds will likely go into deep freeze, traders said.

“This just makes no sense,” said Patrik Kauffmann, a fixed-

income portfolio manager at Aquila Asset Management, who holds

Credit Suisse CoCos. “Shareholders should get zero” because

“it’s crystal clear that AT1s are senior to stocks.”

Perpetual notes issued by Deutsche Bank AG, Raiffeisen Bank

International and BNP Paribas SA all dropped on Monday. Deutsche

Bank’s £650 million ($792 million) 7.125% note fell the most

ever.

The wipeout of 16 billion francs ($17.2 billion) of Credit

Suisse’s so-called AT1 bonds is the biggest loss yet for

Europe’s $275 billion market in these securities, which were

created after the financial crisis to ensure losses would be

borne by investors not taxpayers.

In a typical writedown scenario, shareholders are the first

to take a hit before AT1 bonds face losses, as Credit Suisse

also guided in a presentation to investors recently. That’s why

the decision to write down the bank’s riskiest debt — rather

than its shareholders — has provoked a furious response from

some of the bondholders.

Risky Credit Suisse Bond Wipeout Upends $275 Billion Market

Junior creditors should bear losses only after equity

holders have been fully wiped out, according to a joint

statement from the Single Resolution Board, the European Banking

Authority and the ECB Banking Supervision.

Other European officials also weighed in. ECB Governing

Council member Ignazio Visco said at an event in Milan that that

regulators have the tools to deal with liquidity problems, but

there are no issues currently.

Italy’s Finance Minister Giancarlo Giorgetti said the risk

for Italian banks is “not significant.” He added that he was

“surprised” by the Swiss decision to prioritize shareholders

over some bondholders.

If the AT1 new-issue market reopens, equity conversion may

become the dominant loss-absorption mechanism to reassure

investors that they won’t be wiped out ahead of shareholders,

BI’s Julius said.

To contact the reporter on this story:

Ronan Martin in London at [email protected]

To contact the editors responsible for this story:

Hannah Benjamin-Cook at [email protected]

Beth Mellor, Lynn Thomasson