Avrupa hisse piyasaları hakkında genel bir değerlendirme.,

Bence güzel bir toparlama özeti olmuş. İşin özeti Piyasa ucuz ama büyüme endişleleri hala var. Downside limited olabilir ama gittiği zaman Amerika kadar gitmiyor.

Piyasayı “slightly bullish” olarak değerlendirebiliriz.

Mehmet

European Equities Seen Moving Past August Turmoil: Taking Stock

2024-08-20 06:21:05.948 GMT

By Michael Msika and Sagarika Jaisinghani

(Bloomberg) — With all the caution on the outlook for

stocks for the rest of the year, one consensus conviction

remains among market strategists: European equities are likely

to make new highs.

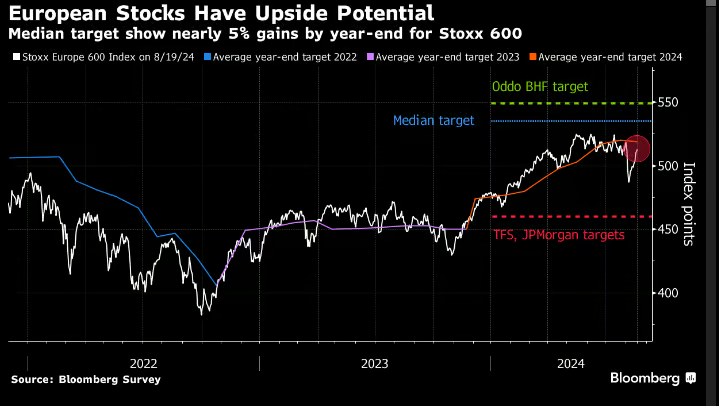

The Stoxx Europe 600 Index is seen ending the year at 535

points — about 4.6% above Friday’s close, according to the

median estimate in a Bloomberg survey of 16 strategists. That

implies surpassing the record high set back in May. Based on the

average target, there is still upside, but only 1.4%.

European stocks have been quick to recoup losses as global

markets rebounded after the wild volatility episode at the start

of August. Mixed economic data and a dramatic unwind of crowded

trades were not enough to derail the rally durably, with

investors banking on interest rate cuts to support equity

valuations. Meanwhile, the earnings season was reassuring. That

kept strategists relatively bullish.

For tables on the Euro Stoxx 50 and Stoxx 600 polls click here,

for a table on the DAX survey here, and for a table on the FTSE

100 here.

“Our target is based on zero earnings growth this year and

next so it’s not ambitious,” says UBS strategist Gerry Fowler,

who sees the Stoxx 600 at 540 by year-end. The market consensus

is for about 4% EPS growth this year and 10% in 2025. “The

driver, therefore, is valuations. Lower bond yields help but

credit spreads continue to grind tighter too.”

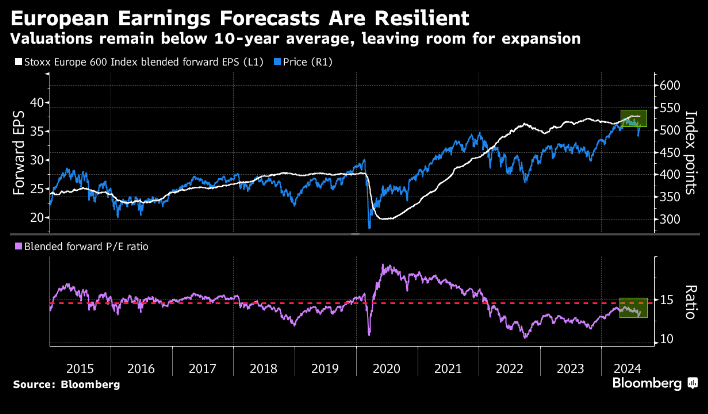

Europe Inc. enjoyed a better-than-expected earnings season

in the second quarter, with MSCI Europe companies posting a 2.3%

rise in profits. That was the first year-on-year increase since

early 2023, according to data compiled by Bloomberg

Intelligence. Yet that strength hasn’t really flowed through to

stock prices, with the benchmark still down about 2% since the

season began mid-July amid lingering worries about the economy.

Analysts have been reluctant to cut their forecasts, and

that’s keeping valuations in check. The Stoxx 600 is trading

below its 10-year average forward P/E, even after the latest

bounce, as shown in the chart below.

While he expects stocks to be slightly down from current

levels, Societe Generale strategist Roland Kaloyan sees limited

downside. The market should find support from central bank rate

cuts, cautious spending by corporates, healthy balance sheets,

as well as the lack of overcrowding in Europe. “Investors have

been on the sidelines on European equities, helping to prevent

excessive valuations,” he says.

Over the past couple of months, the range of forecasts has

narrowed, with less downside seen based on the most bearish

targets. Bank of America strategists were the latest to raise

their view, lifting their target to 475 from 460, though they

are keeping their cautious view. That leaves TFS and JPMorgan as

the most bearish strategists.

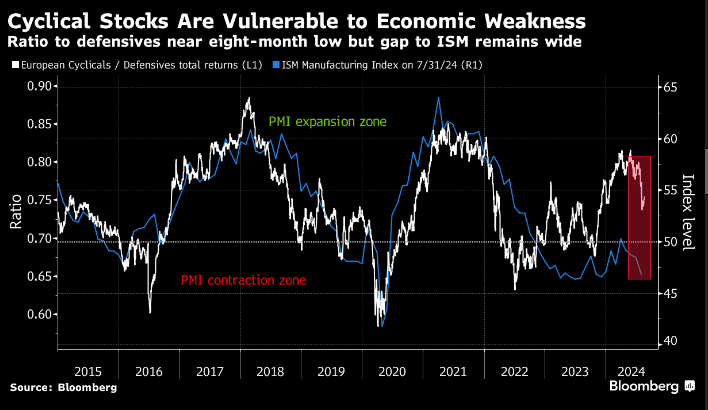

“We remain negative on European equities and cyclicals

versus defensives,” say BofA strategists led by Sebastian

Raedler. “The market ructions in response to the weak July

payrolls print highlight how bad macro data is once again bad

news for the market, as investors‘ focus has shifted from

inflation worries to growth concerns.”

Investors are worried in the near term. According to the

August Bank of America fund managers survey, 48% of European

investors expect near-term downside for European equities, up

from 18% in July, with the share that sees near-term upside

falling to 45% from 78%. That implies a net 4% are now seeing a

near-term pullback, compared with a net 60% seeing upside last

month. Longer-term, conviction is still positive, with 62%

seeing upside over 12 months — though that’s also down from 75%

last month.

MARKETS:

* European index futures are pointing to a slightly higher open,

after a strong handover from Wall Street, as the S&P 500 climbed

for an eighth day, the longest winning streak this year, on bets

the Fed will start cutting interest rates in September. Asian

stocks follow through with the MSCI Asia Pacific up 0.3% after

paring some gains. Japanese indexes lead after yen weakens back

to the 147 handle. The Nikkei jumps 2%. Kospi, Taiex and ASX 200

indexes are in the green. Hong Kong and China benchmarks

underperform. Oil extends its biggest drop in two weeks after

Israel accepted a cease-fire proposal in Gaza. Euro Stoxx 50

futures are up 0.2%, contracts on the S&P 500 are little

changed, and Nasdaq 100 futures are rising 0.1% respectively.

SECTORS IN FOCUS:

* European cybersecurity stocks could be active Tuesday after US

firm Palo Alto Networks issued an upbeat outlook and boosted its

share buyback program.

* European oil stocks could be active on Tuesday after oil

extended the biggest drop in two weeks after the US said Israel

accepted a cease-fire proposal in Gaza, potentially easing

supply risks as concerns about the global demand outlook mount.