By Abhishek Vishnoi

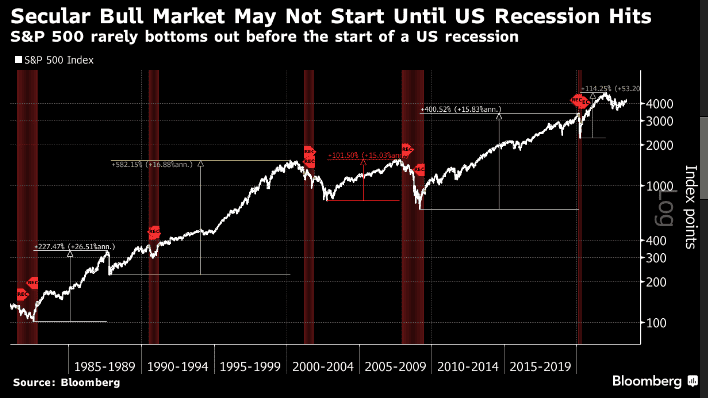

(Bloomberg) — Investors should consider hedging the rally

in the S&P 500 for recession-related risks, say Goldman Sachs

Group Inc. strategists, citing several equity indicators.

Bullish option positions look crowded, the rally has been

narrow, valuations remain high, overly optimistic growth

expectations are being priced in and overall investor posture

isn’t light anymore, strategists including Cormac Conners and

David J Kostin wrote in a note dated June 20.

“We prefer to maintain upside exposure to equity while

utilizing the options market to hedge the potential 23% downside

in a recession scenario,” they wrote. There’s a one in four

chance of recession over the next 12 months and if that prospect

become more likely, the S&P 500 could decline to 3,400, they

added.

Kostin, Goldman’s chief US equity strategist, said in

February that European and Asian stocks are better for investors

to buy than US shares this year due to an expected drop in

corporate profits. That call hasn’t panned out so far.

The S&P 500 has outperformed benchmarks in Europe and Asia

this year, entering a bull market in June, despite warnings of a

recession that’s likely to hit next year. Bulls have instead

focused on a pause in interest-rate hikes, while a frenzied

buying of technology stocks tied to an expected boom in

artificial intelligence’s usage has also trumped all macro

concerns over the market.

Some of the Wall Street’s key strategists, including Morgan

Stanley’s Michael Wilson and JPMorgan Chase & Co.’s Marko

Kolanovic, have for months remained wary of the ongoing rally.

Still, the base case of Goldman’s team is for the S&P 500

to rise to 4,500 by the end of this year, implying a gain of

about 2.5% from here on.

Investors should buy an S&P 500 put spread collar — an

options strategy that involves buying a downside put and selling

an upside call — to hedge a long equity portfolio, Goldman

strategists wrote.

–With assistance from Michael Msika.

To contact the reporter on this story:

Abhishek Vishnoi in Singapore at [email protected]

To contact the editors responsible for this story:

Lianting Tu at [email protected]

Namitha Jagadeesh