By Garfield Reynolds

(Bloomberg) — Goldman Sachs Group added its voice to a

chorus of expectations of a weaker dollar after the US central

bank’s clearest sign yet that interest-rate cuts are coming.

The bank made sweeping changes to its exchange-rate

forecasts after the Federal Reserve signaled a more-rapid move

to “non-recessionary” interest-rate cuts, Goldman analysts

including Michael Cahill wrote in a note on Friday.

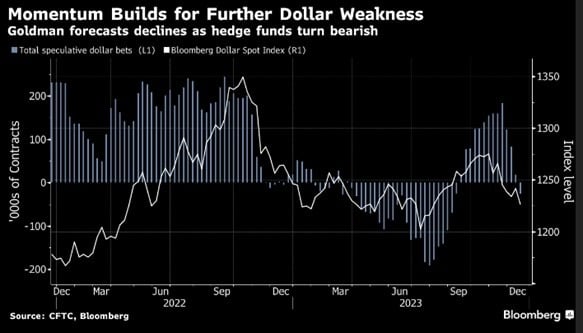

Ahead of the meeting, hedge funds and other large

speculators switched to a net short position against the dollar

for the first time since September, according to Commodity

Futures Trading Commission data as of Dec. 12.

The Bloomberg Dollar Spot Index dropped 1.2% last week and

touched a four-month low after the Fed held interest rates and

projected 75 basis points of reductions in 2024. Markets rushed

to price in as many as six cuts, and Goldman’s economists moved

to anticipate five.

“Our new forecasts incorporate more dollar weakness than

before,” the Goldman analysts wrote. “The biggest revisions to

our forecasts are in the rate-sensitive currencies that would

have struggled under a ‘higher for longer’ rates regime,” such

as the yen, the Swedish krona and the Indonesian rupiah, they

wrote.

The combined position for bets across major currencies

shifted to a net 26,355 contracts bearish on the dollar in the

week ending last Tuesday, the CFTC data show. The biggest shifts

were for the yen, with bets on dollar gains versus the Japanese

currency dropping by more than 20%, and for the British pound,

where wagers on dollar declines almost doubled.

The yen soared 2% last week against the dollar, while the

krona added 1.9%. Those were the biggest gains among G-10

currencies outside of Norway’s krone, which jumped more than 4%

as its central bank unexpectedly lifted its key deposit rate.

A weaker dollar next year is the majority view among

analysts surveyed by Bloomberg across the Group-of-10 nations

and emerging markets, yet Goldman previously only anticipated a

“shallow” depreciation, forecasting the dollar index to drop 3%

over the next 12 months in their 2024 currency outlook published

Nov. 10.

Goldman now sees the yen little changed at 142 per dollar

in six months, significantly stronger than its prior estimate of

155. It also boosted projections for the Australian and New

Zealand dollars by at least 9% over the same horizon.

“We see the most ‘room to run’ from current levels in pro-

cyclical currencies that should benefit from the Fed loosening

its grip on financial conditions and adding to the case for a

soft landing,” the strategists wrote. That group includes the

British pound, the South Korean won and the South African rand.

–With assistance from Alice Atkins.

To contact the reporter on this story:

Garfield Reynolds in Sydney at [email protected]

To contact the editors responsible for this story:

Tian Chen at [email protected]

Toby Alder, Tan Hwee Ann