Lira Plunges as Turkey’s New Economy Team Pulls Back Defense (3)

2023-06-07 11:22:05.804 GMT

By Tugce Ozsoy, Kerim Karakaya and Beril Akman

(Bloomberg) — Turkey’s lira plunged to a record low as

state-run lenders temporarily halted dollar sales, in a sign the

new economic team is abandoning a costly intervention strategy

as part of an expected turn toward more conventional policies.

The Treasury and Finance Ministry, under its newly

appointed chief Mehmet Simsek, asked the central bank to ease

off on currency-market interventions via the state banks, people

with knowledge of the matter told Bloomberg on Wednesday, asking

not to be named because the discussions were private.

When the lira’s decline exceeded 6% on the day, the

Treasury allowed the sales to resume, according to one of the

people. The central bank and Treasury declined to comment.

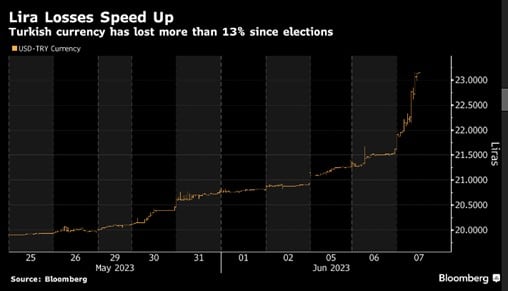

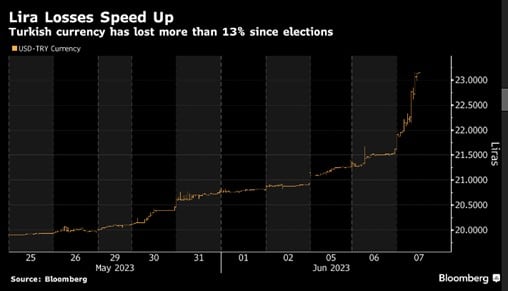

The currency had earlier dropped about 7%, the most in more

than a year, to as low as 23.1734 per dollar, weakening for a

12th straight day. It was trading 6.7% lower at 1:10 p.m. in

Istanbul.

The new economy chief’s request partially reverses policies

in place since August, when the central bank tightened its grip

over the currency. Dollar sales and a tangle of banking

regulations aimed at reducing demand for hard currency held the

lira relatively stable until the second-round presidential

election on May 28.

President Recep Tayyip Erdogan, who won reelection to a

five-year term, has long championed an unorthodox economic

policy based on ultra-low interest rates. The costs of that

policy piled up in the form of depleted foreign-currency

reserves, an inflationary spike, and an exodus of foreign

capital, leading markets to price in a large depreciation after

the vote as investors bet that it was unsustainable.

Minister Simsek

Erdogan’s appointment of Simsek, a former Merrill Lynch

strategist, has intensified expectations of a return to

orthodoxy and abandonment of state intervention in favor of

allowing the market to determine fair value for Turkish assets.

Since the election on May 28, the lira has weakened more than

13% against the dollar.

Investors are betting that more weakness is coming. The

options market is currently pricing about an 80% chance that the

lira will hit 25 per dollar within the next three months, and a

more than 60% chance that it could hit 27 per dollar, according

to data compiled by Bloomberg.

Turkey’s state banks don’t comment on their interventions

in the foreign-exchange market. A former governor of the central

bank said in 2020 that state-owned lenders carry out

transactions in line with regulatory limits and could continue

to be active in the currency market.

While the lira plunged, other corners of the Turkish market

indicated confidence in the policy shift. The main stocks index

rose 3.3%, extending gains since the vote to 22% and reversing

this year’s losses. Turkey’s dollar bonds also extended their

advance, with the extra yield investors demand to hold Turkey’s

dollar debt over US Treasuries narrowing 44 basis points this

week, according to a JPMorgan Chase & Co. index.

The central bank’s next meeting to set interest rates is

scheduled for June 22 and investors expect a hike, fueled by

projections of a change at the top post, currently occupied by

Governor Sahap Kavcioglu. Like Erdogan, Kavcioglu has championed

low interest rates, cutting the benchmark rate to 8.5% from 19%

during his tenure even as inflation accelerated to a 24-year

high above 85% last year.

Read more: Global Banks Try to Put a Number on Turkish Rate

Hike This Month

Hafize Gaye Erkan, a banking executive in the US, is a

potential candidate for governor and met Simsek on Monday in

Ankara, people with knowledge of the discussions told Bloomberg.

Read more: Turkey Sounds Out First Republic’s Ex-Exec Over

Central Bank Job

Erkan worked for nearly a decade at Goldman Sachs Group

Inc. and she’s the former co-CEO of San Francisco based lender

First Republic Bank. Just over a year after her departure from

First Republic, it became the second-biggest bank failure in US

history.

Simsek and his team will face an uphill battle, with the

lira’s weakness adding to elevated inflationary pressures ahead

of local elections next year. Despite headline inflation’s

slowdown last month, core inflation accelerated.

What Bloomberg Economics Says…

“We expect the government’s pricing and tax policies,

together with pre-election and quake related fiscal spending and

an accommodating monetary policy stance, to add to inflationary

pressures going forward. As such, we forecast price gains to

move back above 40% in the summer and end the year at 43%.”

— Selva Bahar Baziki, economist. Click here to read more.

Goldman Sachs Group Inc. analysts recently revised their

forecast for the dollar-lira pair higher, citing increased

pressure on the currency. The bank sees the lira depreciating to

28 per dollar in 12 months, compared with a previous projection

of 22, according to a report dated June 3.

–With assistance from Yumi Teso.

To contact the reporters on this story:

Tugce Ozsoy in Istanbul at [email protected];

Kerim Karakaya in London at [email protected];

Beril Akman in Ankara at [email protected]

To contact the editors responsible for this story:

Benjamin Harvey at [email protected]

John Viljoen, Charles Penty