Lira Longer-Term Risks Climb Ahead of Election Runoff

Turkey’s Delayed Policy Adjustment May Lead to a Currency Crisis

(Bloomberg Intelligence) — Turkish President Recep Tayyip Erdogan’s advantage ahead of an electionrunoffsuggests near-term policy continuity and only gradual adjustment thereafter. This may prevent the lira from falling to a forwards-implied level of 24 vs. the dollar in 3Q while risking continued largebalance of payments deficits and potentially a disorderly lira devaluation. (05/22/23)

- Downward Pressure on Lira Set to Persist Without Policy Changes

The lira lost some 20% vs. the dollar over the past year, among the weakest performances globally,despite persistent FX interventions. The central bank, compelled to support the government’s pro-growth agenda, failed to curb a credit and consumption boom by maintaining extremely loosemonetary policy. A win for the opposition is likely to be seen as leading to much higher policy ratesand capital inflows, and a more flexible (initially much weaker) currency.

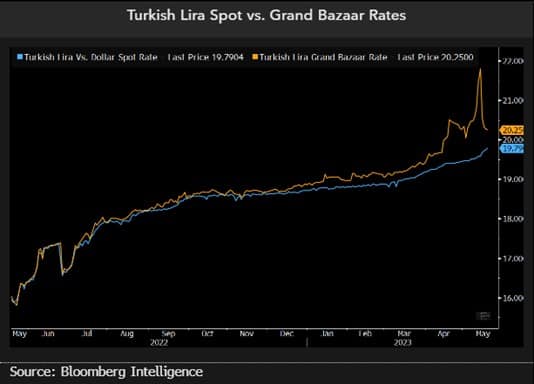

Since late 2022, tighter currency controls led to growing difference between the official spot andstreet exchange rates (as reported by exchange bureaus in Istanbul’s main market area), to 3.4% onaverage in April and 11% on the eve of the election. The sharply scaled-down expectations for near-term policy changes has cut this difference to about 3% at present. (05/22/23)

2. Central Bank Reserves May Remain Under Pressure

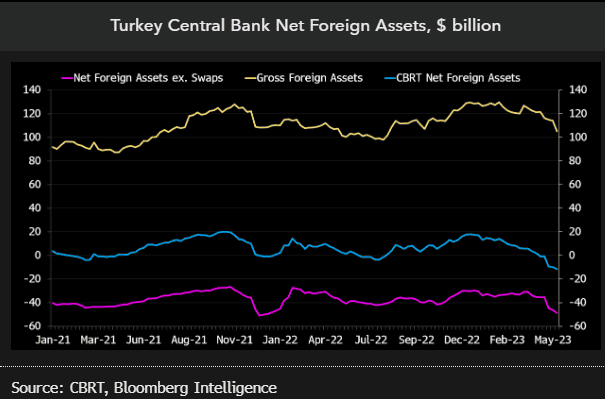

Turkey’s massive FX interventions in support of the lira despite a large current account deficit remaina key vulnerability. Year-to-date, central bank gross and net foreign assets fell by nearly $24 and $29billion, respectively. Excluding swaps with commercial banks, net assets fell to minus $49 billion as ofMay 12, the lowest since early 2022. Over the previous week, foreign currency reserves fell by arecord $7.6 billion, or 11%. Outflows have likely picked up since the May 14 vote. To counter risingdownward pressure on the lira, the central bank last week sought to fresh restrictions on gold and FXpurchases but later reversed the move.

The ability to raise sizeable external financing (from Gulf countries and Russia) has allowed Turkey tokeep its unsustainable policy mix so far, but a revision is now urgent. (05/22/23)

3. External Imbalances Pose Significant Currency Risks

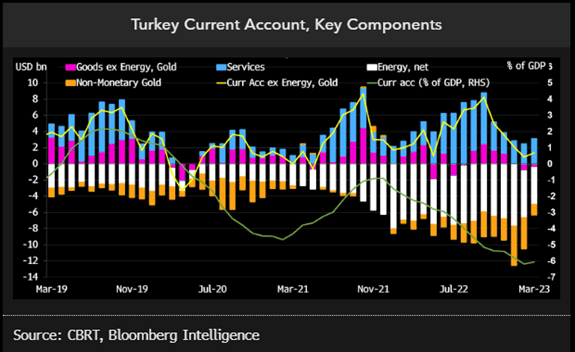

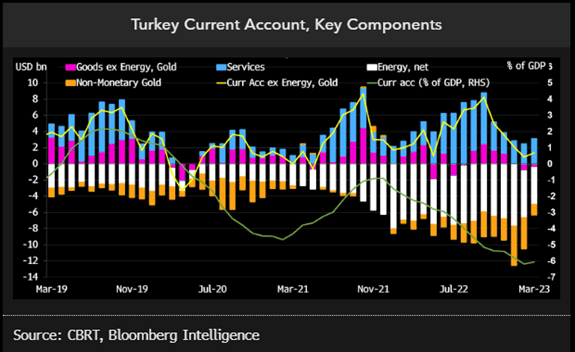

The combination of pro-growth policies, a spike in energy prices and strong household demand forimported gold have led to an increase in the current account deficit to more than 6% of GDP in 1Qfrom 0.9% in 2021. Major policy inconsistencies prompted foreign investors to sharply reduce theirholdings of Turkish securities, with negative implications on the cost of foreign borrowing.

Turkey’s large FX-debt payments should ultimately compel any incoming government to reduce thecountry’s external vulnerabilities. Turkey’s sovereign debt payments will rise to $14 billion and $18billion in 2024 and 2025, respectively, vs. $11 billion in 2023. Total FX debt payments by all Turkishentities over the next four quarters are about $200 billion, underscoring the need for an urgentreturn to more orthodox macroeconomic policies. (05/22/23)

4. Quick Policy Reaction to Currency Jitters Is Unlikely

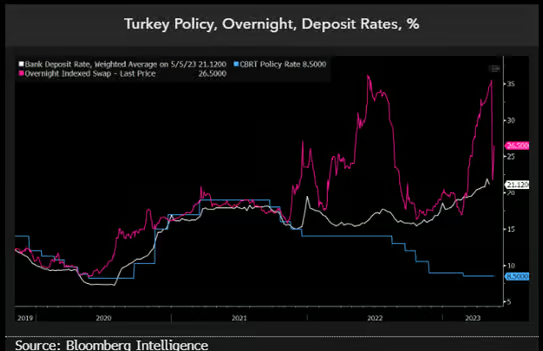

The central bank is highly unlikely to be in a position to start policy tightening at the next policymeeting on May 25, prior to the second round of the presidential election on May 28. Rates havebeen kept on hold at 8.5% since February, despite the need to assist earthquake rebuilding andpolitical preferences for further cuts, as downward pressure on the exchange rate mounted.

Forward market expectations for the policy rate in three months have collapsed to about 20% afterthe election’s first round, from above 35% ahead of the vote. Notably, on a one-year horizon therepricing has been far less sharp, still pointing to a rate pick up to about 29%. Ultimately, the timingof rate hikes will be determined by the central bank’s ability to contain depreciation pressure from itsown (and quickly eroding) pool of reserves. 05/22/23