By Beril Akman

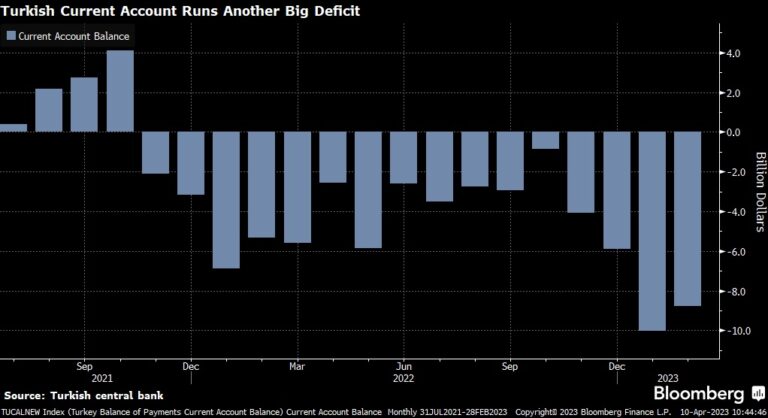

(Bloomberg) — Turkey’s current-account balance stayed deep

in the red in February, a key vulnerability for the economy as

President Recep Tayyip Erdogan’s government tries to keep the

lira and inflation in check ahead of elections next month.

The shortfall in the broadest measure of trade in goods and

services was $8.78 billion, the Turkish central bank said in a

report on Monday, more than forecast by economists. That

compares with a record deficit in January that was revised to

$10 billion and a gap of $5.3 billion in February 2022.

With Turkey long hobbled by trade imbalances, Erdogan

envisions the economy generating a current-account surplus by

lifting exports thanks to a weak currency. But Russia’s war

against Ukraine has pushed up energy prices while exports

haven’t been able to keep up with imports.

The two main drivers of the deficit have been purchases of

energy and gold, especially as households increasingly turned to

bullion to shield themselves against inflation that climbed over

85% last year.

Though Turkey limited some gold imports in the aftermath of

the deadly earthquakes in February, net non-monetary imports of

the precious metal reached nearly $4 billion, Monday’s data

showed.

While price gains have started to cool, economists still

expect year-end inflation to be above 40%, or eight times higher

than the central bank’s official target.

In a stark change from last year, capital of unknown origin

has also become a drag on the current account. Still, after

recording outflows in January, net errors and omissions saw an

inflow of about $1 billion that eased pressure on Turkey’s

reserves to fund the deficit.

Inflows related to net errors and omissions were a key

source of covering the gap in 2022. Central bank reserves fell

by $4.7 billion in February.

The services industry recorded a surplus of $2.3 billion,

mostly driven by tourism revenue. Portfolio investment had a net

inflow of $240 million.

To contact the reporter on this story:

Beril Akman in Ankara at [email protected]

To contact the editors responsible for this story:

Onur Ant at [email protected];

Sylvia Westall at [email protected]

Paul Abelsky