By Neil Callanan and Tasos Vossos

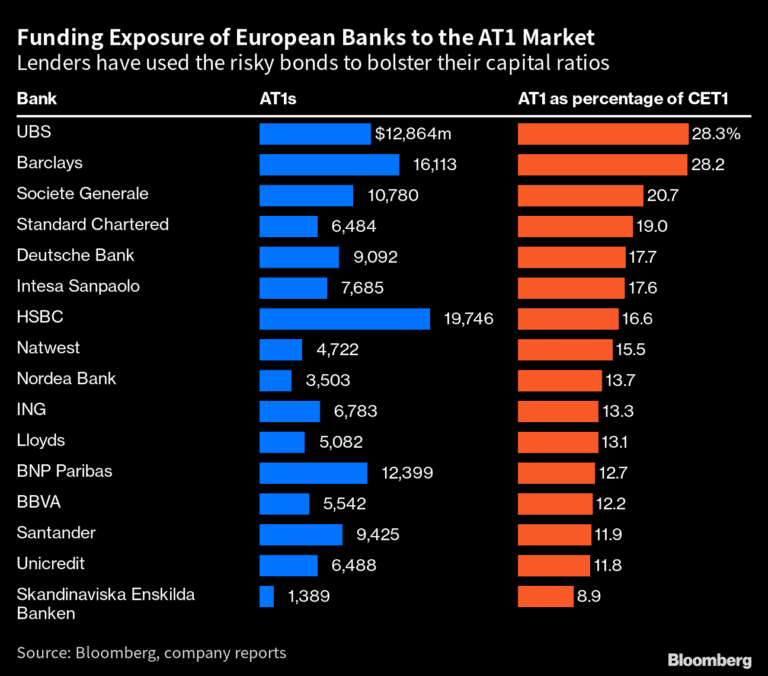

(Bloomberg) — UBS Group AG is more reliant for its capital on the type of risky bonds that were wiped out in the Credit Suisse Group AG takeover than any other major lender in Europe.

Additional Tier 1 bonds, or AT1s, are the equivalent of about 28% of the Swiss lender’s highest quality regulatory capital, according to Bloomberg calculations. That’s just

slightly more than for Barclays Plc, while the average exposure among the 16 biggest banks in Europe is about 16%. The notes have been a key way for banks to bolster their

financial resources because they are typically cheaper than normal equity such as shares. They were created by European regulators after the financial crisis as a way to impose losses on creditors when banks start to fail without resorting to taxpayer money.

“From a capital perspective, if AT1 funding costs rise by an extreme amount over time, we believe there may potentially arise a situation in which banks look to replace AT1 capital

with CET1 capital,” Goldman Sachs analysts led by Chris Hallam wrote in a note.

A historic writedown of 16 billion francs ($17.2 billion) of the risky bonds issued by Credit Suisse has sent shockwaves through the market, with bondholders arguing that shareholders should have taken the first hit. Regulators in the European Union and UK reiterated on Monday that equities should take losses before any bonds in their jurisdictions.

AT1 bonds have historically been a cheaper way for banks to boost their capital, but the events of the past few days have turned that on its head. Major European banks’ cost of equity capital now averages 13.4%, based on data compiled by Bloomberg. That’s lower than the average yield across AT1 bonds, which jumped to 15.3% after the Credit Suisse wipeout. In early February, yields on AT1s stood at 7.8%, according to a multi-currency index compiled by Bloomberg.

In Europe, no other major banks besides Credit Suisse and UBS have provisions that would allow for the full writedown of this type of bond, according to senior Bloomberg Intelligence

credit analyst Jeroen Julius. This feature allowed equity investors to maintain some value as bondholders were wiped out.

UBS didn’t respond to a request for comment. Barclays didn’t have an immediate comment.

“A likely development is the cost of issuing such bonds will increase to reflect increased perceived default risk,” Credit Suisse banking analysts including Jon Peace wrote in a

note. “At the margin this could reduce somewhat European banks’ profitability.” The team published a similar chart on AT1s on Monday.

To contact the reporters on this story:

Neil Callanan in London at [email protected];

Tasos Vossos in London at [email protected]

To contact the editors responsible for this story:

Dana El Baltaji at [email protected]

Beth Mellor